This data, which emerged from the research New Threats, New Strategies: Between Climate Risks, Cyber and Demographic Winter , conducted by EY for the Italian Insurtech Association (IIA) , highlights a sector called upon to redefine priorities, business models and sustainability metrics in the face of a new wave of systemic risks that impact both the economic stability and the social fabric of the country.

The research, conducted on a panel of 20 operators including Italian companies, brokers, and insurtechs , analyzed not only how the market is responding to the increasing frequency of catastrophic events, but also to the spread of digital risks and the need for protection linked to the aging population.

Source: New Threats, New Strategies: Between Climate Risks, Cyber, and Demographic Winter, EY for the Italian Insurtech Association

Climate Risks and Insurance: The New Frontier of Financial Resilience

The increase in extreme events is pushing the market towards a phase of maturity in the insurance offering linked to natural catastrophes (NatCat).Companies have already consolidated a portfolio of solutions ranging from property extensions (80%) to stand-alone coverage (73%) for earthquakes, floods or hailstorms , while sectors such as agriculture are starting to benefit from more specific products.

Less widespread, however, are business interruption coverage (33%), parametric policies (13%) and mutualistic solutions (7%), thus highlighting a gap between innovative potential and actual adoption.

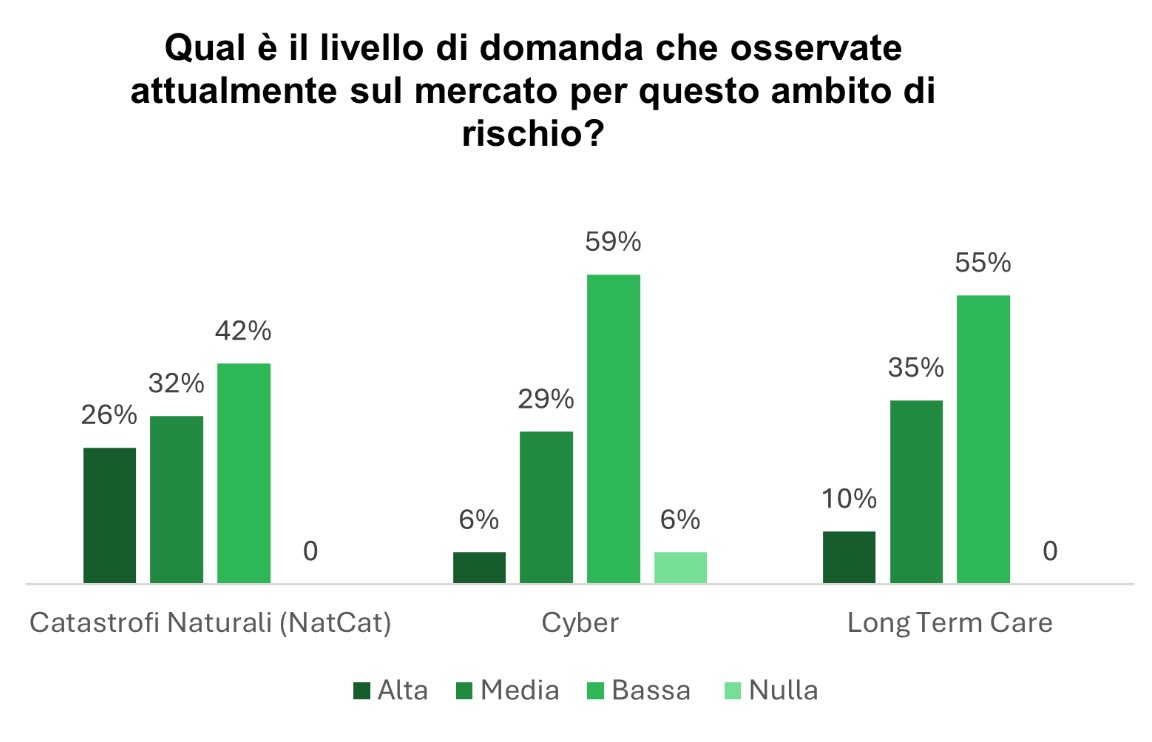

The real crux of NatCat, however, remains demand. Despite increased risk awareness, end customers continue to show strong price sensitivity , limiting the policies' penetration.

Demographic aging: long-term care as a lever for social impact

The issue of non-self-sufficiency is taking on an increasingly central role in the financial planning of Italian families.65% of companies have included Long Term Care (LTC) products in their catalogues , but demand is not taking off and remains anchored at low levels (as confirmed by 55% of those interviewed), held back by a limited perception of need and a widespread underestimation of the cost of long-term care .

The most innovative organizations are introducing integrated services, ranging from certified home care (70%) to personalized care management (50%) and agreements with nursing homes and healthcare facilities (45%). The goal is to raise awareness of the added value of coverage that, in addition to protecting individuals, also serves a redistributive function and alleviates the burden on public welfare.

For a rapidly aging country, LTC represents a strategic direction both in terms of ESG and in terms of protecting human capital.

Cyber risk: a gap between perception and vulnerability

While climate risks now appear to be consolidated in market awareness, cyber risks continue to be underestimated .Despite more than half of operators having introduced dedicated solutions (around 53%), demand remains weak and does not reflect the actual exposure of companies and citizens.

The reasons? 29% don't consider potential risks a priority, while the remainder are divided between those who are in the evaluation or implementation phase.

The most common risk coverages to date are malware, ransomware and cyber extortion (100%), data breach (78%) and business interruption (56%).

To try to bridge the gap between the need for coverage and low risk awareness, industry operators are pushing for awareness campaigns , the inclusion of prevention and monitoring services, and product simplification.

In this sense, the most effective channels are partnerships with IT and cybersecurity providers, followed by specialized insurance consultants and traditional agency networks, which maintain a significant role especially in the SME segment.

“Our industry is at a turning point.

New threats, from climate to cyber, to demographic aging, require a profound reflection on protection models.

It's no longer just about selling a policy, but about building a relationship of trust and prevention with the customer: this, after all, is the meaning of insurance inclusion.

The urgent need is to use these tools to bridge the gap between the market and consumers in a country still under-penetrated by insurance.

"Insurance inclusion means transforming digitalization into concrete levers to break down cultural and bureaucratic barriers and create insurance that is truly accessible to everyone," commented Simone Ranucci Brandimarte, president of the Italian Insurtech Association. (Source: https://esgnews.it/ )